If your tenant has violated the terms of the lease and failed to fix the situation, an eviction may be warranted. The first order of business to protect your investment is to have clear policies for what is expected of your tenant spelled out in the lease agreement. Always consult your lease agreement, along with a local lawyer, before initiating an eviction process, and keep in mind that certain states and cities may have temporary moratoriums on eviction that may apply. Before you hand over the keys to your property, both you and your tenant should consider signing a rental agreement to help prevent disputes and headaches when questions arise. A lease should specify all requirements and expectations between you and your tenant. Sometimes people incorrectly use the terms “absolute NNN lease” and “triple net lease” interchangeably.

Check leasing specials

Real estate rentals are initiated by a rental application which is used to build the terms of the lease. In addition to the basics of a rental (who, what, when, how much), a real estate rental may go into much more detail on these and other issues. The real estate may be rented for housing, parking vehicles, storage, business, agricultural, institutional, or government use, or other reasons. A fixed term tenancy what is an accountant and what do they do comes to an end automatically when the fixed term runs out or, in the case of a tenancy that ends on the happening of an event, when the event occurs. Such a tenancy is generally “at will,” meaning the tenant or the landlord may terminate it at any time, upon the providing of proper statutory notice. The Lessor transfers the rights of the immovable property for a long period of time and works on the property.

How does a lease impact a company’s financial statements?

Remember, aligning your lease with the state and local laws governing your rental property is paramount. Non-compliant terms can render portions of your agreement unenforceable and may even jeopardize the validity of other clauses. The landlord may also include rules about how much decoration and personalization the tenant can do and whether they can sublet, either long-term or short-term using vacation rental services. In California, landlords can use security deposits to cover unpaid rent, repair damages not considered ordinary wear and tear, and cover the cost of excessive cleaning if necessary. The lease should also include where and how the security deposit should be paid, a deadline for payment, and a description of how the deposit will be held and returned to the tenant.

You’re our first priority.Every time.

It is a good idea to communicate in writing to document the situation in case it becomes necessary to take the matter to court. A tenant has the right to file a civil lawsuit against a landlord in breach of their lease. Once you’ve applied and been accepted by the landlord, you’ll be given a lease. You can also look for an apartment that offers a month-to-month lease, though these can be more expensive. In college towns, leases may revolve around the school year, allowing students to go home for the summer and pay for a shorter term.

Do you already work with a financial advisor?

Key issues in the lease include the length of the tenancy, the rent amount and security deposit, the maximum rental occupancy, and sublease conditions, as well as restrictions, such as pet size or number. Any other restrictions should be listed in the rental agreement, as well as rules regarding parking and the use of common areas. The sublessor remains liable to the original lessor in accordance with the initial lease, including all remaining rent payments, including operating expenses and all other original lease terms. In a down-market, the original lessee may require a lower rent payment from the sublessee than what he or she may have originally paid, leaving the remaining rent owed to the lessor to be paid by the original lessee. However, if market prices have increased since the original lease was signed, the sublessor might be able to secure a higher rent price than what is owed the original lessor.

Advantages of using a fixed-term lease

Lease contracts allow for standard wear and tear like minor scuff or spills. But at the end of your lease, you’ll have to return the car in the condition it was in when you got it. If you return a car with excessive wear and tear — things like damaged parts, permanent stains, broken glass or the like — you can incur fees. Leasing requires qualified and experienced people at the helm of its affairs. Leasing is a specialized business and persons constituting its top management should have expertise in accounting, finance, legal and decision areas.

Lessor and Lessee

- Some people require the assistance of service animals to help with a disability, so be sure you know the laws and exceptions around renting to those with service animals.

- A lease agreement is a legal contract used when a party conveys land or personal property to another party for a specific amount of time in return for payment.

- The lease should include instructions on how the security deposit can be used, but it must be legally compliant for it to be applicable.

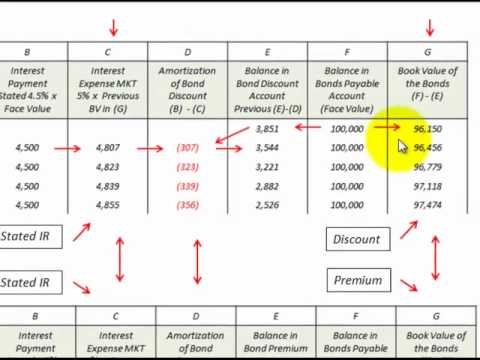

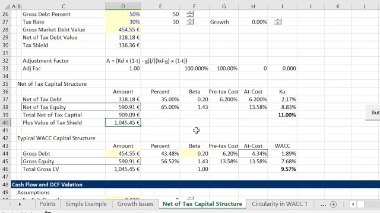

For Lessee Accounting, a capital lease is recorded both as an asset and a liability, whereas operating lease expenses are recognized as rental expenses. For Lessor Accounting, a capital lease is recorded as a receivable, while an operating lease continues to be recorded as an owned asset. The lessor borrows funds from the lender to purchase the asset, which is then leased to the lessee. In a sale and leaseback arrangement, an asset’s owner sells the asset to another party and then leases it back. This arrangement allows the original owner to continue using the asset while freeing up capital.

In this type of lease, the lessee sells the asset to the lessor with an advance agreement between the two of leasing the asset back to the lessee for a fixed lease rental period. Consideration – Lawful consideration is necessary for the fulfillment of a contract of lease. The transfer of the rights of the immovable property is made by giving consideration in the form of money as premium or rent, shared profit or as share of crops and services. If you’re always leasing, you’ll be consistently paying monthly payments but won’t ever own the vehicle like you would when you buy a car. The amount of security deposit you can collect can depend on your circumstances and local law.

In reality, fully understanding a commercial lease requires attention to detail and help from a tenant broker. Who will be responsible for paying property taxes and insurance — you or the landlord? To discover the answers to those important questions, you need to know exactly what kind of commercial lease you are https://www.bookkeeping-reviews.com/ signing. A lease is an arrangement under which a lessor agrees to allow a lessee to control the use of identified property, plant, and equipment for a stated period of time in exchange for one or more payments. There are several types of lease designations, which differ if an entity is the lessee or the lessor.

This section should also cover any penalties that might apply if the tenant or the landlord tries to terminate the lease before the end of the agreement. For example, the agreement might state that the property can be used only for residential occupancy and specify the maximum regular occupancy. If the tenant will be protected by rent control, these details should appear in the rental agreement. If a lease exists at the sole discretion of the landlord, the law of the jurisdiction may imply that the tenant is granted, by operation of law, a reciprocal right to terminate the lease at will. Some kinds of leases may have specific clauses required by statute depending upon the property being leased, the jurisdiction in which the agreement was signed, and the residence of the parties.

Not all leases are designed the same, but all of them have some common features. These include the rent amount, the due date of rent, the expiration date of the lease. The landlord requires the tenant to sign the lease, thereby agreeing to its terms before occupying the property.

Most people believe that lessees prefer leasing because of the tax benefits it offers. In reality, it only transfers the benefit i.e. the lessee’s tax shelter is the lessor’s burden. The lease becomes economically viable only when the transfer’s effective tax rate is low. Our easy-to-use technology and responsive team of real estate professionals delivers the most transparent, flexible experience in the market.

All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. 11 Financial is a registered investment adviser located in Lufkin, Texas. 11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. 11 Financial’s website is limited to the dissemination of general information pertaining to its advisory services, together with access to additional investment-related information, publications, and links. Leasing also carries legal aspects, with an emphasis on agreement adherence, termination procedures, and default remedies.

Since then, Pureval has declined comment on the commission’s specific recommendations and asked the city manager for a review of them by the end of June. Leasing Lunken to CVG would get the city out of a business not essential to most city residents and into the hands of “the experts at CVG,” the commission report said. The Lunken story starts with Frederick Lunkenheimer, who left Germany in 1845 and arrived in Cincinnati in 1854. In 1862, he created Cincinnati Brass Works to make parts for steamboats and military equipment. In 1889, just weeks after renaming the company Lunkenheimer Valve Co., he died at 63, leaving son Edmund in charge. The lessor arranges for the equity and the financier has the responsibility to finance the debt.

For instance, a college student who plans to leave town each summer may be unable to fulfill a long-term agreement, and the alternative leasing options mentioned above would be ideal. When deciding between leasing an apartment vs. renting, you must consider how long you will rent the unit. Amiteria testified at the trial that she had never purchased renter’s insurance since she moved into the premises fourteen years earlier, in 1998. The trial court decided that failure to obtain insurance was not a material breach, and therefore could not lead to a forfeiture of the lease. Since laws change, however, consider incorporating a severability clause. This provision safeguards your lease by stipulating that if any part of it is deemed invalid, the rest remains valid and in force.